The tools you need for the finances you want

“A fresh user experience, a concise and helpful dashboard, and innovative views … that keep you in sync with your finances.”—PCMag

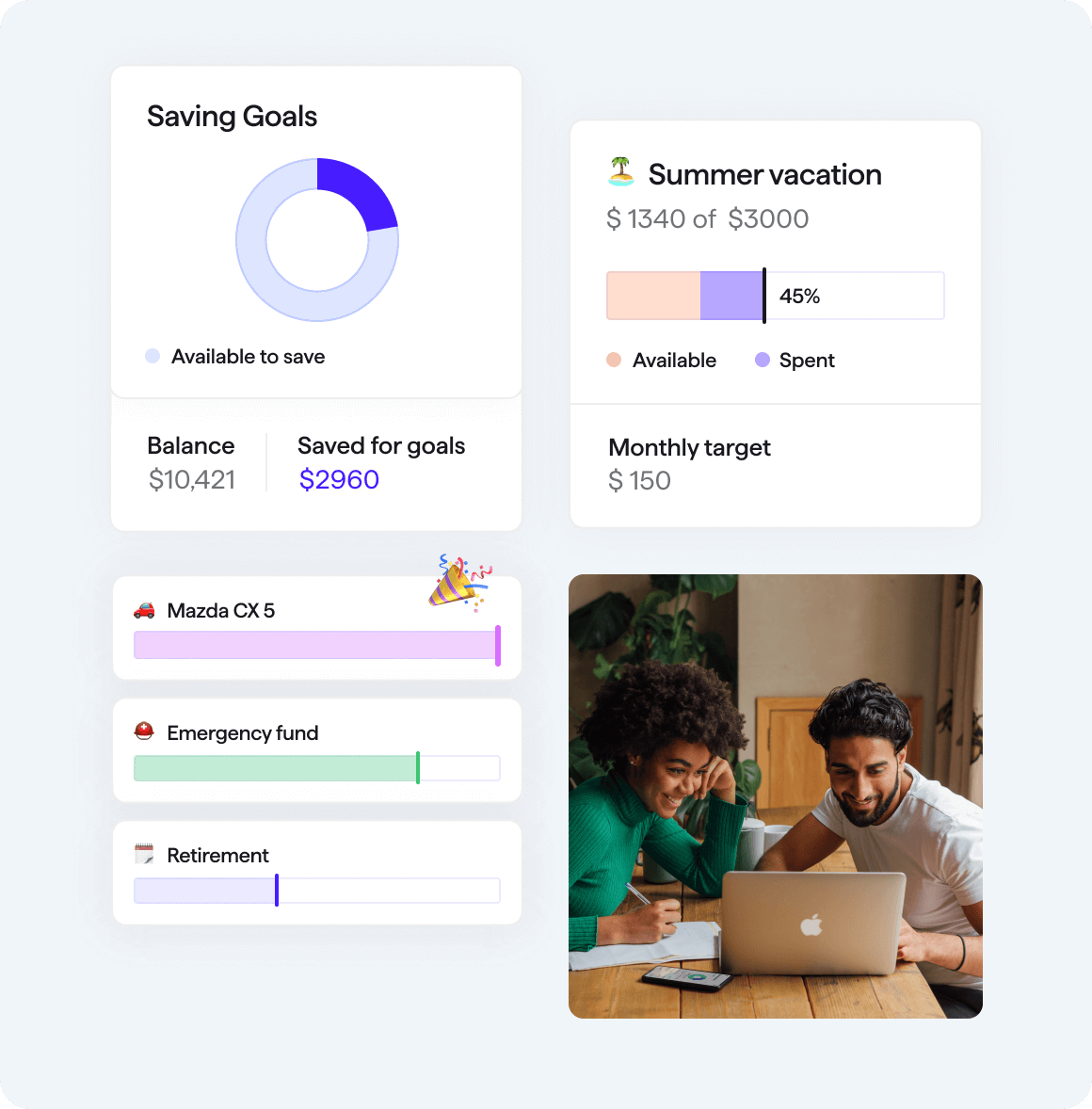

Easy-to-use, custom Savings Goals help you track your progress and reach every goal, from vacations and vehicles to emergency funds and retirement.

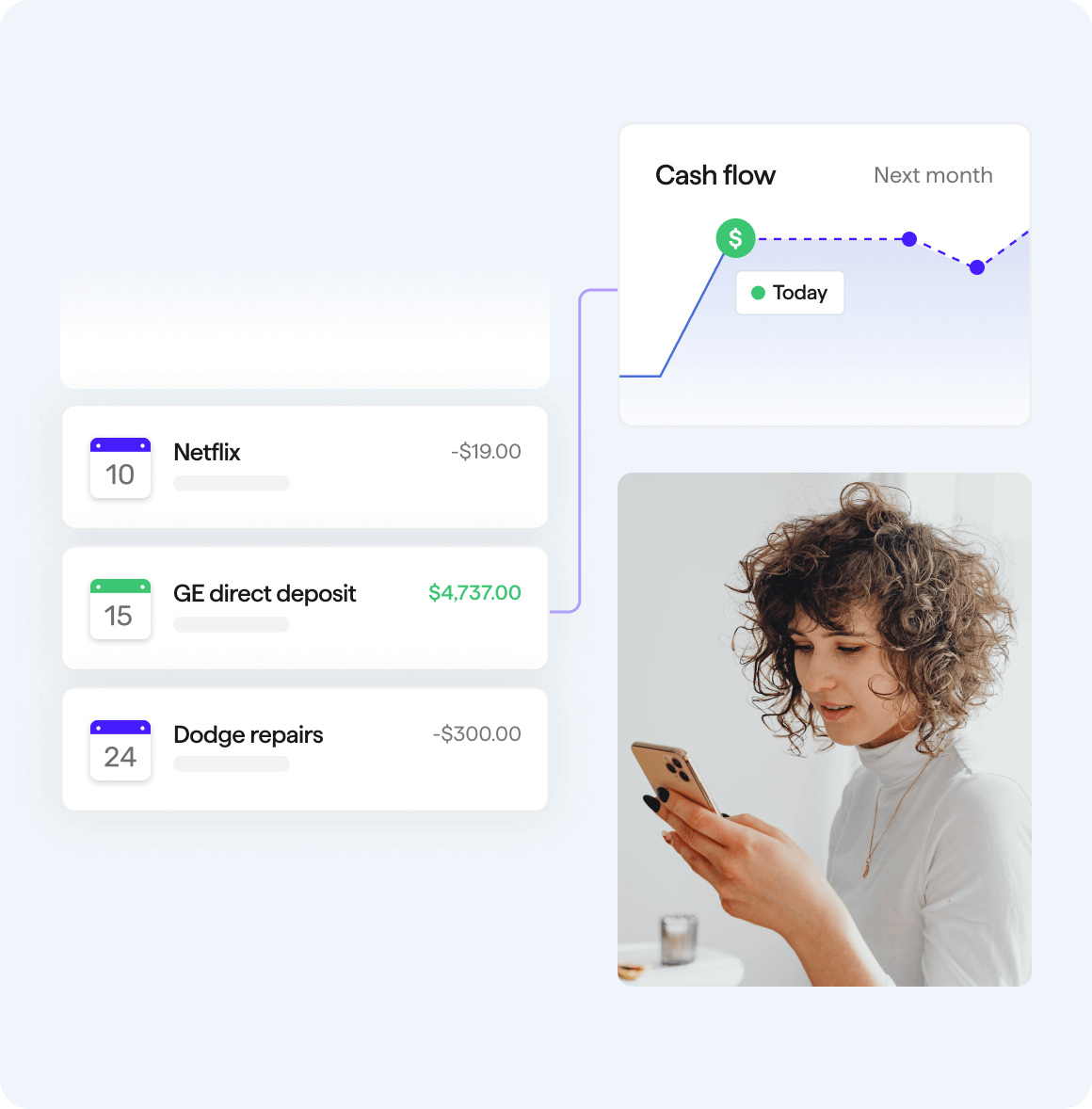

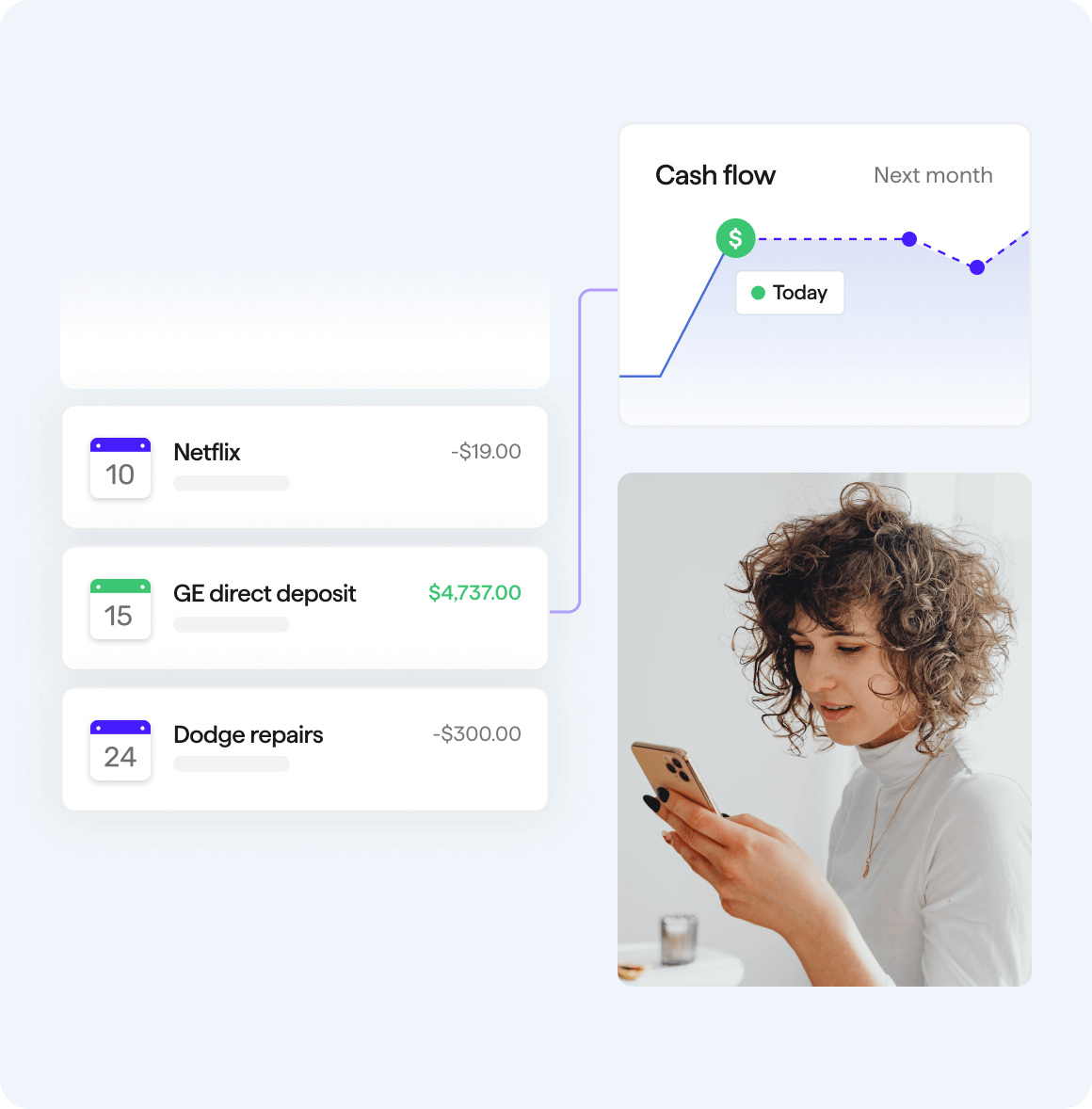

Get a personalized spending plan based on your income & expenses. See where your money is going and instantly know how today’s new shoes will affect tomorrow’s concert tickets.

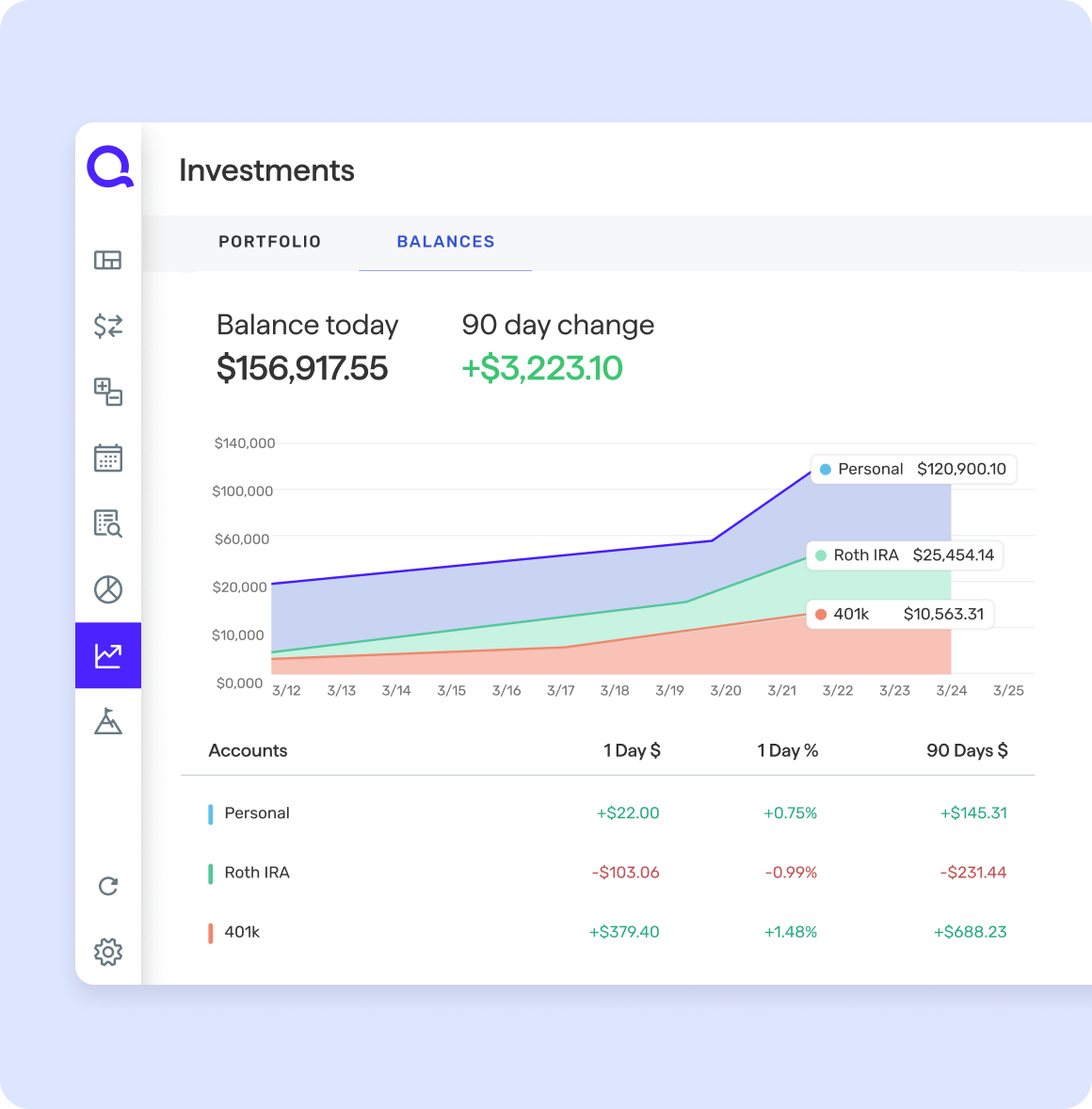

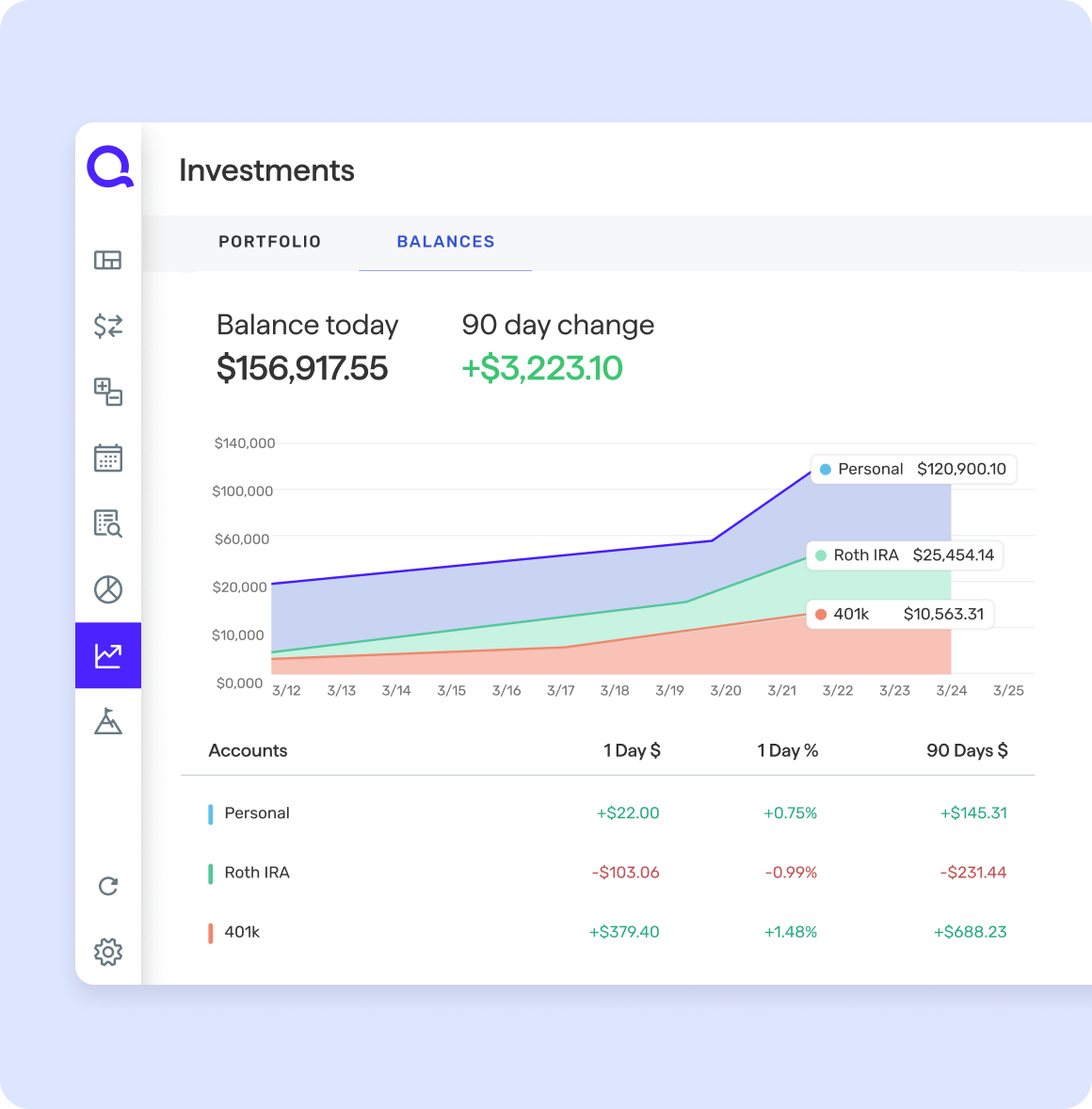

Run automatic, fully customizable reports on your spending, income, net income, and savings, and take action with confidence.

Get timely alerts about unusual or unexpected transactions, upcoming bills & subscriptions, or when you’re near your spending limits.

Download and categorize your transactions automatically. Then customize them with tags, flags & more to easily track & manage your spending.

Quicken Simplifi

Quicken Classic

Quicken Simplifi is a powerful, easy-to-use tool for all the essentials of your financial journey. Track & categorize your spending. Get an automatic, fully customizable spending plan. Reach your savings goals. Plan for the future with projected cash flows. No matter where you are on your personal finance journey, Quicken Simplifi has you covered.

Quicken Simplifi doesn’t force you to choose a single budgeting system. Instead, it starts with your monthly income, subtracts your bills & subscriptions, and generates a personalized Spending Plan that adjusts automatically as you spend. No matter how you like to budget, the tools in Quicken Simplifi can accommodate any method you like to use — zero-based budgeting, envelope budgeting, 50-30-20, and more.

See how much you have left to spend per day for the rest of the month, calculated automatically

Add any planned spending, from groceries to birthday dinners, to set aside the money you need

Include your savings goals in your plan so you don't spend that money by mistake

Easily ignore any spending that you don't want to count toward your monthly budget

Yep! You can share your Quicken Simplifi account with your partner, financial advisor, or anyone you trust. Add them with our “Spaces” feature so you can each log in whenever you choose. You can even add more than one person if you want to.